If you walk in to a rental car agency and ask to rent a car, you’ll be required to sign paperwork. The paperwork is a safeguard from the company. You’ll also be asked if you want to pay for optional damage insurance.

When you decline to pay for insurance, you’ll be responsible for any damage to the vehicle when it’s in your care.

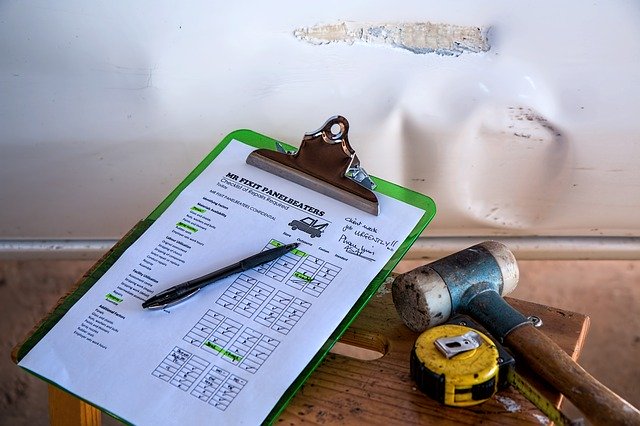

The person that is helping you with your rental should do a quick inspection of the vehicle, along with you, to document any damage that may already exist. There are almost always scratches and dents on a rental car.

If you choose to pay for the additional insurance, you’ll be paying for:

- Collision damage waiver (CDW)

- Loss damage waiver (LDW)

A CDW or LDW waives the rental companies right to make the renter (you) pay for damages to the vehicle.

Should You Pay for the CDW or LDW?

If you talk to ten people, you’ll have some that will tell you to always pay for the additional insurance and others that say to never pay for the additional coverage. When renting a car, you may notice dents or scratches.

A lot of rental car companies will take your money, but they will not repair the vehicle for minor dents or cosmetic damage.

A CDW or LDW is going to do a few things:

- Waive the rental car company’s right to pursue damages against you

- Lower the risk of having to deal with “estimates”

If you’re in an accident and don’t pay for the additional coverage, the rental car company will come after you for damages. You’ll have to pay for an “estimate” of repairs without much documentation to explain the repairs.

The company may choose not to repair the vehicle, or they may pocket money and charge you an exorbitant amount of money for no reason.

Before paying a dime, you’ll want:

- Estimates of the repairs required

- Invoices showing the repairs were made

You have a right to know what damages you caused and the cost to repair the supposed damages. If you do not request invoices before payment, there’s no way to know if the repairs were made, or if the rental company pocketed the money.

If you want to avoid any potential hassles or liability, pay for the additional coverage.

What’s Not Covered by the Insurance

You’re in a car accident, but the accident was your fault. Maybe you were speeding, or maybe you changed lanes without looking and caused an accident.

A lot of renters think that the optional coverage they paid for will cover the other vehicle that was damaged.

But that’s not the case.

The rental car company waives your responsibility for damage that happened to the rental car. You will be held liable for damages you caused if you were in the wrong.

When You Can Deny Coverage

You may already have additional coverage without knowing it. Paying $10 to $30 a day for additional coverage is not required if you meet the following requirements:

- Pay with a credit card that offers collision damage protection as a benefit (you can call your credit card issuer for more details)

- Check your auto insurance policy to see if it extends to rental cars

You’ll spend 15 to 20 minutes checking these policies, but you may not have to pay for additional coverage. Deductibles from your insurance company will still apply, so you will have to shoulder some of the financial burden.

Purchasing a loss damage waiver is more about peace of mind and avoiding the hassle of dealing with credit card and insurance companies. If damage occurs to the vehicle, the rental company waives all of their rights to pursue damages. Insurers and credit card companies may fight with you and require a lot of paperwork to be filled out.